Did you know that 61% of small businesses face cash flow issues due to delayed payments? For many organizations, managing Accounts Receivable (AR) is one of the most critical yet challenging aspects of maintaining financial health. It’s not just about collecting payments—it’s about ensuring cash flow consistency, minimizing delays, and building trust with customers.

Consider a growing business with an expanding client base. Despite steady sales, their receivables kept piling up due to delayed acknowledgments and inconsistent follow-ups. What should have been a cash flow asset became a financial liability, disrupting operations and limiting growth opportunities.

To address these challenges, forward-thinking organizations are turning to automation. ARth, an AI-powered Accounts Receivable Automation Application introduced by Embee, provides a smarter way to manage receivables. ARth is designed to streamline AR processes, ensure real-time insights, and automate repetitive tasks that slow businesses down—all while empowering businesses to make better financial decisions.

Challenges Businesses Face in AR Management

Managing accounts receivable may seem straightforward, but it often presents significant hurdles, especially for businesses relying on manual processes.

Here are some of the most common challenges organizations face:

1. Manual Invoice Submissions

Teams often prepare and send invoices manually, increasing the risk of errors such as mismatched details, incorrect GST information, or missing attachments. These errors not only delay payment cycles but also frustrate clients, straining business relationships.

2. Inconsistent Follow-ups

Without a structured approach, reminders for overdue payments are often inconsistent. Some clients might receive late notifications, while others might not be contacted at all. This lack of consistency leads to extended payment cycles, increasing the likelihood of overdue receivables.

3. Invoice Acknowledgment Issues

Customers frequently raise concerns about incorrect invoices—whether it’s mismatched purchase orders, incomplete service period details, or inaccurate tax information. Resolving these issues manually adds further delays to the acknowledgment process and creates additional administrative burdens for the AR team.

4. Lack of Transparency

Many AR teams still rely on spreadsheets and disconnected tools, leading to siloed operations. This lack of real-time visibility into receivables makes it challenging for management to identify overdue accounts, track escalations, or assess overall AR performance effectively.

5. Limited Credit Risk Assessments

Evaluating a customer’s creditworthiness is essential for proactive decision-making. However, many businesses only conduct these assessments sporadically, exposing themselves to the risk of bad debts. Without a clear view of customer risk levels, AR teams often struggle to prioritize follow-ups effectively.

The Role of Automation in Solving AR Problems

Manual processes are not only time-consuming but also prone to human error. By automating tasks like invoice generation, follow-ups, and reporting, businesses can significantly reduce operational bottlenecks. More importantly, AI-driven automation enables organizations to act proactively, addressing potential issues before they escalate.

A robust AR automation solution like ARth not only resolves current inefficiencies but also future proofs your receivables process.

1. Automated Invoice Management

ARth automates the preparation, digital signing, and delivery of invoices. This ensures customers receive accurate, timely invoices, reducing errors and disputes that delay payments.

2. Smart Acknowledgment Process

ARth enables customers to acknowledge, dispute, or raise queries directly through a dedicated platform. This feature streamlines communication and ensures faster resolution of invoice-related concerns, saving time for both businesses and clients.

3. AI-Driven Follow-ups

ARth replaces manual reminders with AI-driven workflows that send personalized follow-ups at set intervals. If payments remain overdue, the system escalates unresolved cases to higher management for quicker action and accountability.

4. Centralized Dashboard

ARth provides a real-time overview of receivables, from overdue payments to upcoming dues. Its centralized dashboard allows businesses to track top debtors, categorize accounts by risk level, and monitor overall AR performance metrics.

5. Comprehensive Credit Risk Assessment

ARth periodically evaluates customer creditworthiness and categorizes accounts into risk levels using a simple color code system (e.g., Red: High Risk, Orange: Medium Risk, Green: Low Risk). This empowers businesses to take pre-emptive action and reduce exposure to bad debts.

What Makes ARth the Perfect AR Solution?

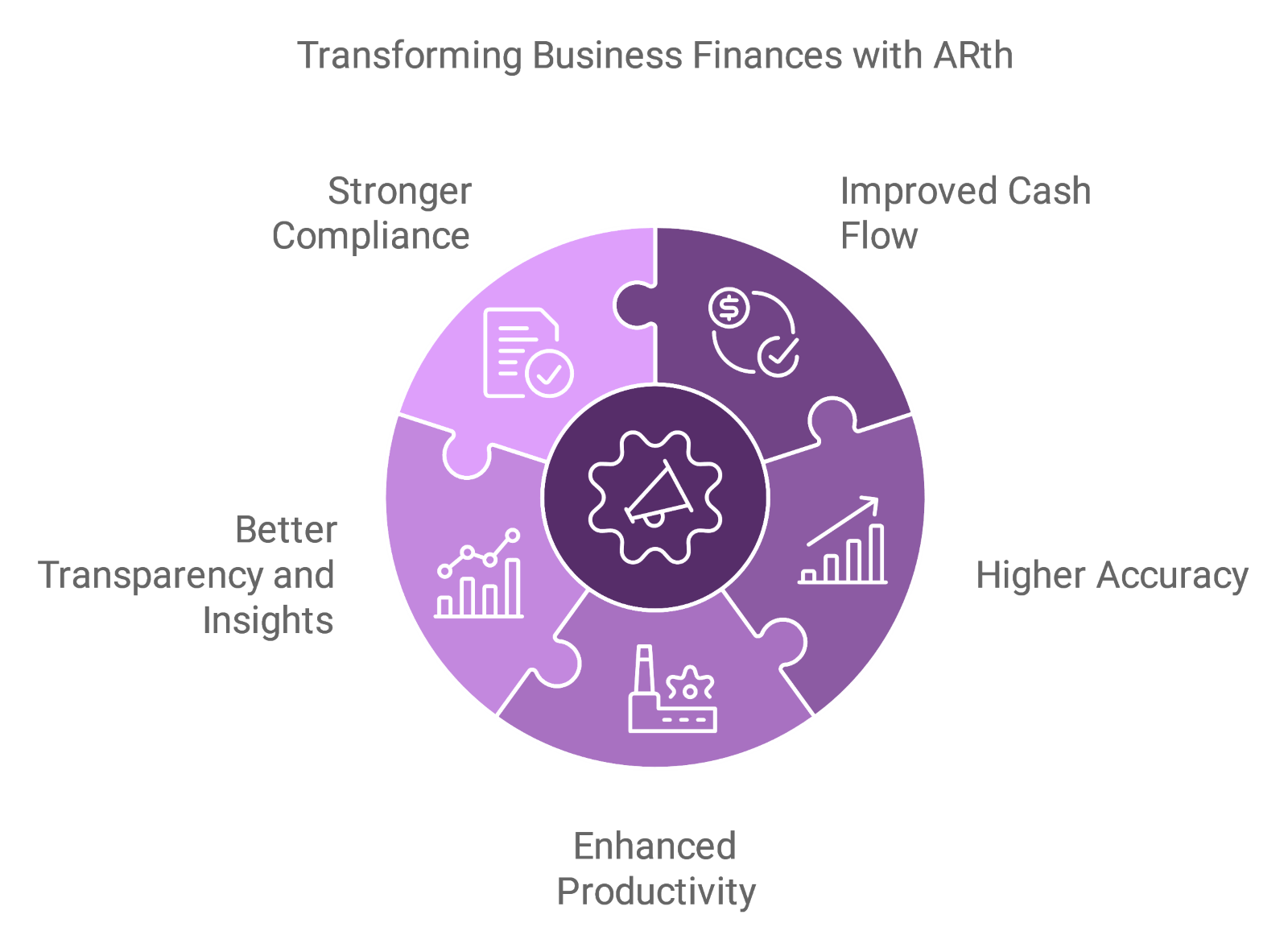

The implementation of ARth delivers tangible benefits that extend far beyond day-to-day operations.

Here’s how businesses are transforming their financial health with AI-powered AR solutions like ARth:

1. Improved Cash Flow

Faster follow-ups and error-free invoicing significantly reduce Days Sales Outstanding (DSO), ensuring a steady cash flow and greater financial stability.

2. Higher Accuracy

Automation eliminates manual errors in invoicing and acknowledgment processes. The result? Fewer disputes, faster resolutions, and increased customer satisfaction.

3. Enhanced Productivity

By automating repetitive tasks, ARth frees up teams to focus on high-value activities such as strategic planning, customer engagement, and business growth initiatives.

4. Better Transparency and Insights

With centralized dashboards and real-time data, businesses gain a comprehensive view of receivables. This enables informed decision-making, effective resource allocation, and proactive risk management.

5. Stronger Compliance

ARth ensures systematic documentation and audit-ready records, helping businesses meet statutory and regulatory requirements with ease.

Summing Up

Managing accounts receivable is no longer just a financial function—it’s a strategic enabler for business growth. ARth represents a paradigm shift in how businesses handle receivables, offering a streamlined, AI-driven approach to eliminate inefficiencies, enhance transparency, and foster growth.